Historical Model Development

We began the development of the Geneva Financial Model by focusing our evaluation on several hundred of the most widely known US based household names, known for their size and financial strength, in the US. This primary focus on large cap stocks creates an inherent long-term bias towards lower risk investments relative to a focus on smaller, perhaps less established and/or less financially strong companies.

The distinguishing feature of the Geneva Financial model is the unique, proprietary way in which the criteria are combined, resulting in a rigorous quantitative screening process designed to filter out a list of equities for investment. Our model was developed and tested from 1996 back to 1975, thus establishing the model over a wide variety of socioeconomic conditions. The result is a very optimized portfolio of stocks which we invest for you. This portfolio typically holds 20-30 stocks.

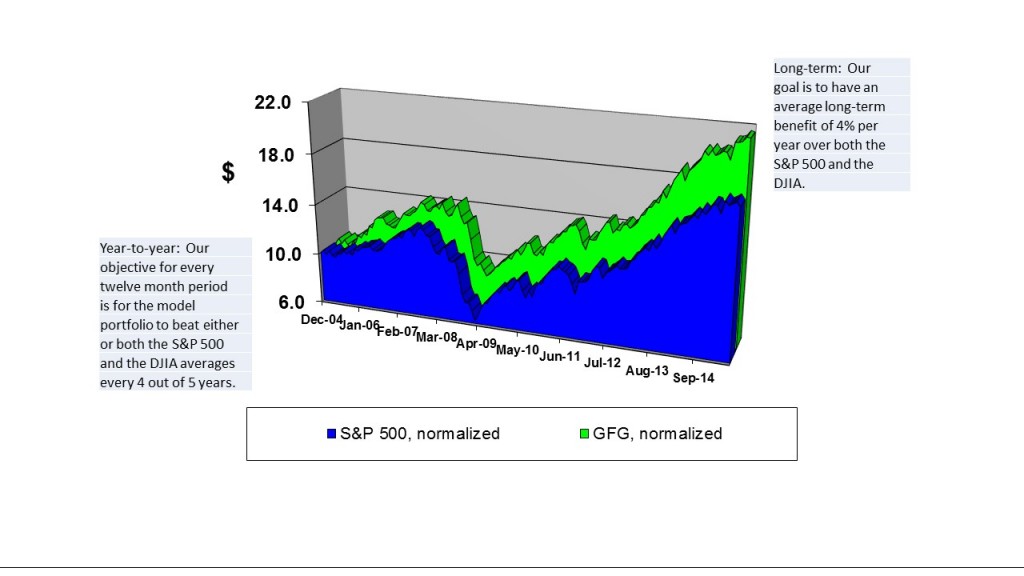

Our model represents growth and value investing in large cap U.S. blue chip companies. Our goal is to have an average long term benefit of over 4% per year over both the S&P 500 and the DJIA. Performance is net performance, considering all commissions and fees, as well as all interest and dividends obtained, in the model account. There is no guarantee that future predictions of common stock performance will be accurate.

Past Performance